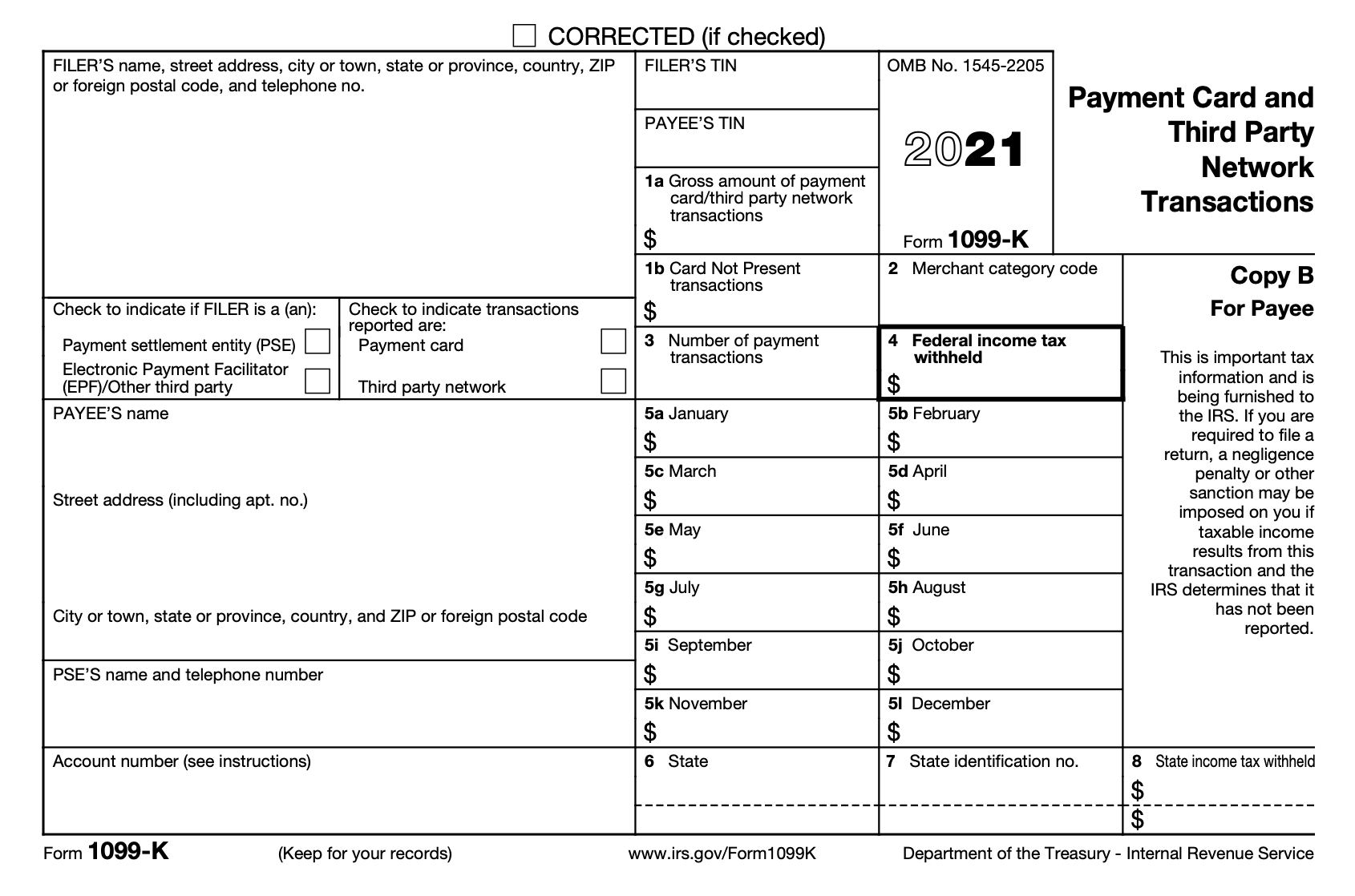

1099-K Tax Form

FutureFund will provide you with comprehensive insights into the 1099-K Tax Form, its purpose, and how it impacts your financial records.

Overview

Each year, the United States IRS requires that FutureFund provide a form called a 1099-K for each fund that meets all of the following criteria in the previous calendar year:

- Account is based in the United States AND

- $5,000 USD in total gross volume in a calendar year

If your fund qualifies for a 1099-K, your 1099-K for the previous calendar year will be mailed USPS to the address on file prior to January 31.

The 1099-K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. It is provided to you and the IRS, as well as some US states. For more information, see Understanding Your Form 1099-K.

Was this helpful?