Tax Receipts

FutureFund can send tax receipts to purchasers with at least one tax deductible purchase in the past calendar year.

We adhere to the requirements specified in the IRS Publication 1771 - Charitable Contributions: Substantiation and Disclosure Requirements with the exception of the $250 threshold. We send for any amount.

Program Details

Before sending the email, please verify the fund’s Tax ID is accurate as emails can only be sent once.

- This feature is available in the month of January of each year and will cover all live school sessions.

- Purchase items whose tax deductible flag is checked at the time of purchase are included in the receipt. Changing the tax deductible flag for a campaign will not include previously purchased items.

- This feature is not automatic. An admin must initiate the send request. (See below)

- Test orders will not receive an email.

- Refunded orders will not be included.

- One email is sent per purchaser for all funds in the account. Funds cannot be excluded.

- The order must be paid in full. Installment payments that are not paid will be excluded.

Sending Tax Receipts

To send tax receipt emails:

- Log in to the Admin, select Store > Setup.

- Scroll down to the Tax Receipts section.

- Click the Send Tax Receipts button.

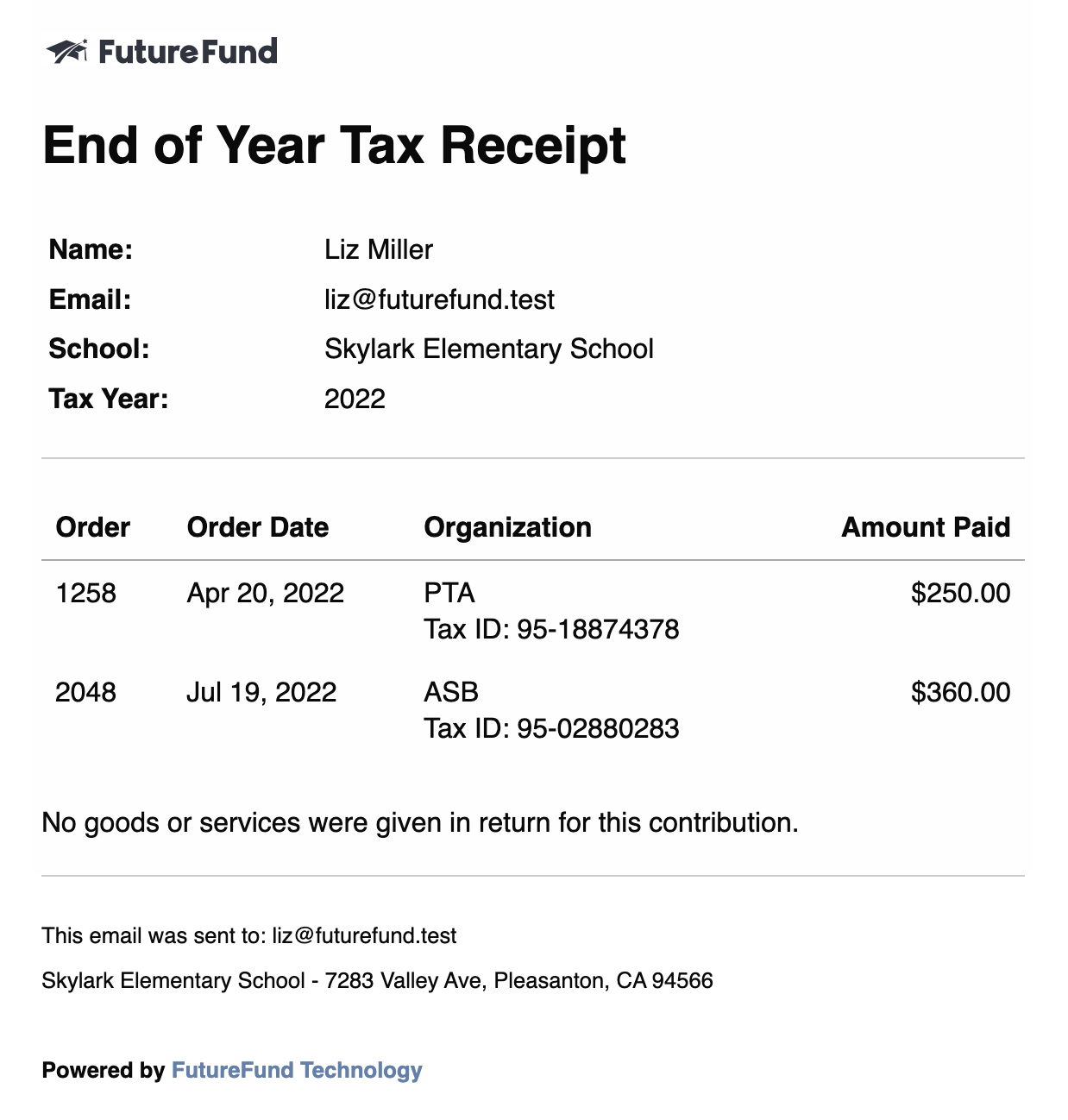

- A form will be displayed allowing customization of the tax message which appears at the end of the email. See Sample Email

- Click the Send Tax Receipts button.

If the button is not present, you cannot send tax receipt emails. Please see the Program Details section.

Sample Email

Was this helpful?