A dispute (also known as a chargeback) occurs when a cardholder questions your payment with their credit card company. To process a chargeback, the bank creates a formal dispute which, if lost, will reverse the payment.

The payment amount, along with a separate $15.00 dispute fee, will be deducted from your account balance.

Notifications and Responses

When a dispute is received:

- An email is sent to the purchaser and account owner. See below for more information.

- Alerts are placed on the order and transactions informing the admin of the dispute.

FutureFund will respond to the dispute by:

- Submitting the required evidence to the issuing bank.

Order and Transaction Alerts

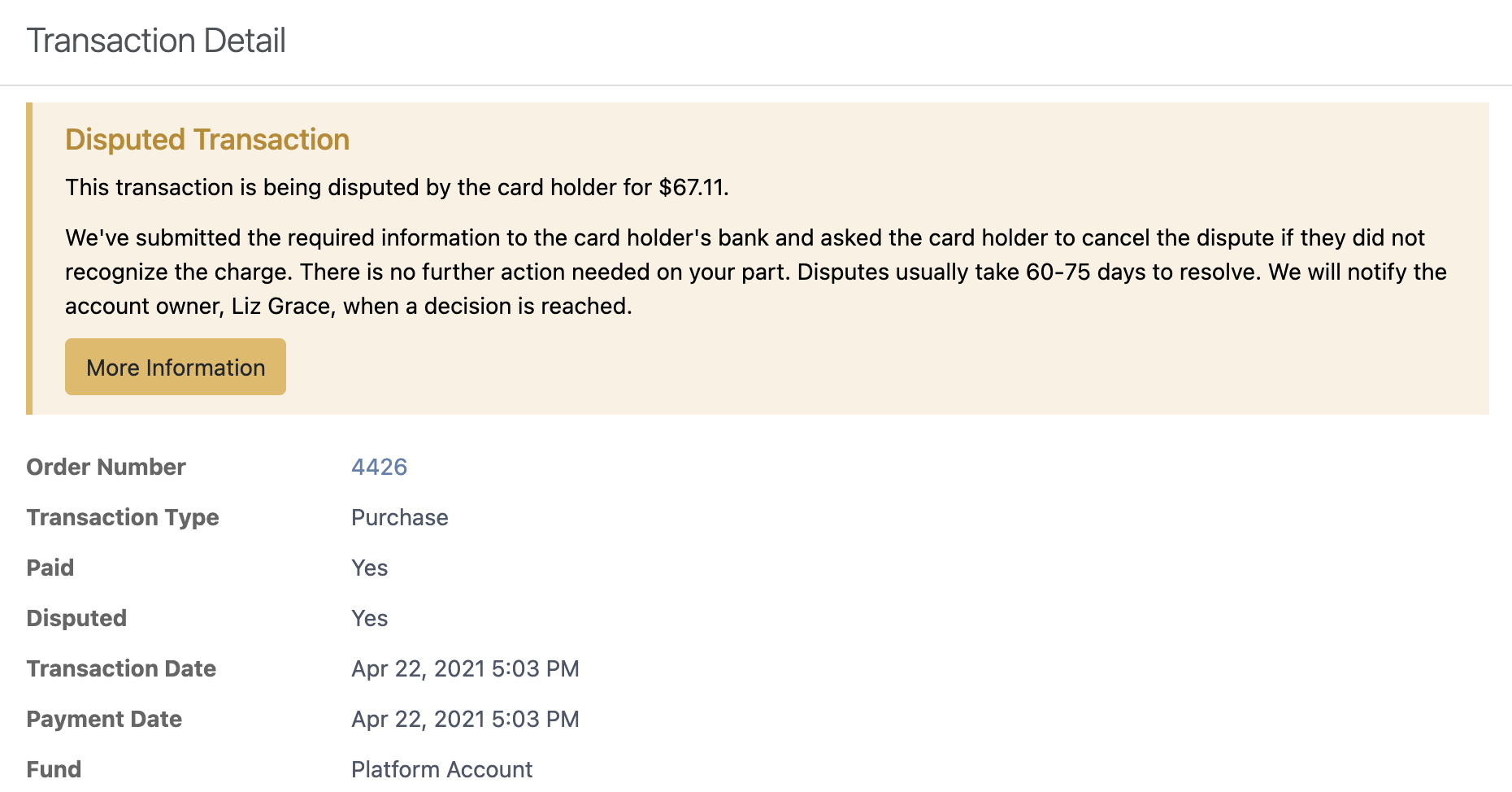

The following alert is displayed on orders and transactions when a dispute is pending. Disputes that are won are not displayed in the admin.

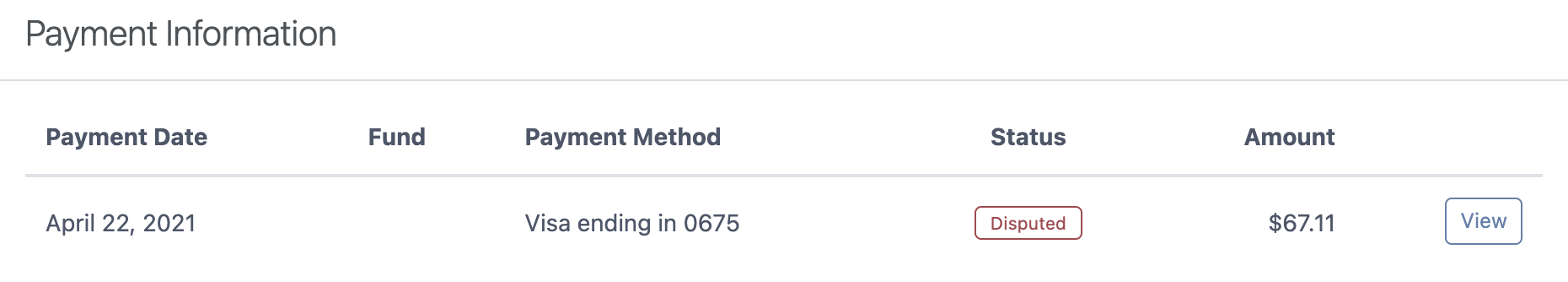

Transaction listings will include the dispute label for their status:

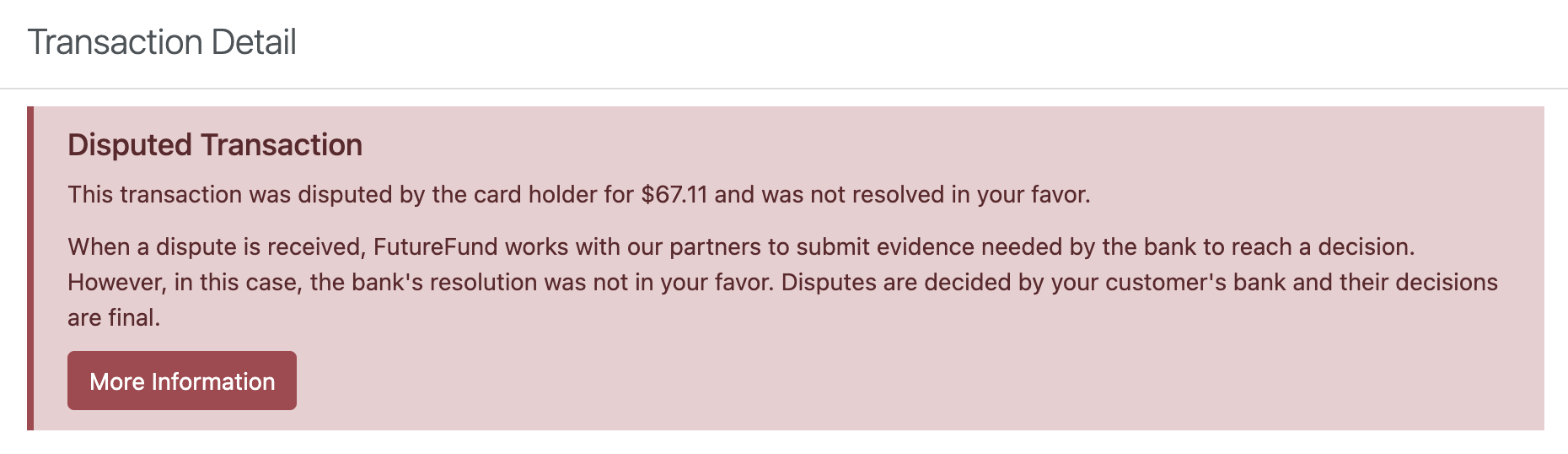

Lost disputes display the following alert.

Dispute Emails

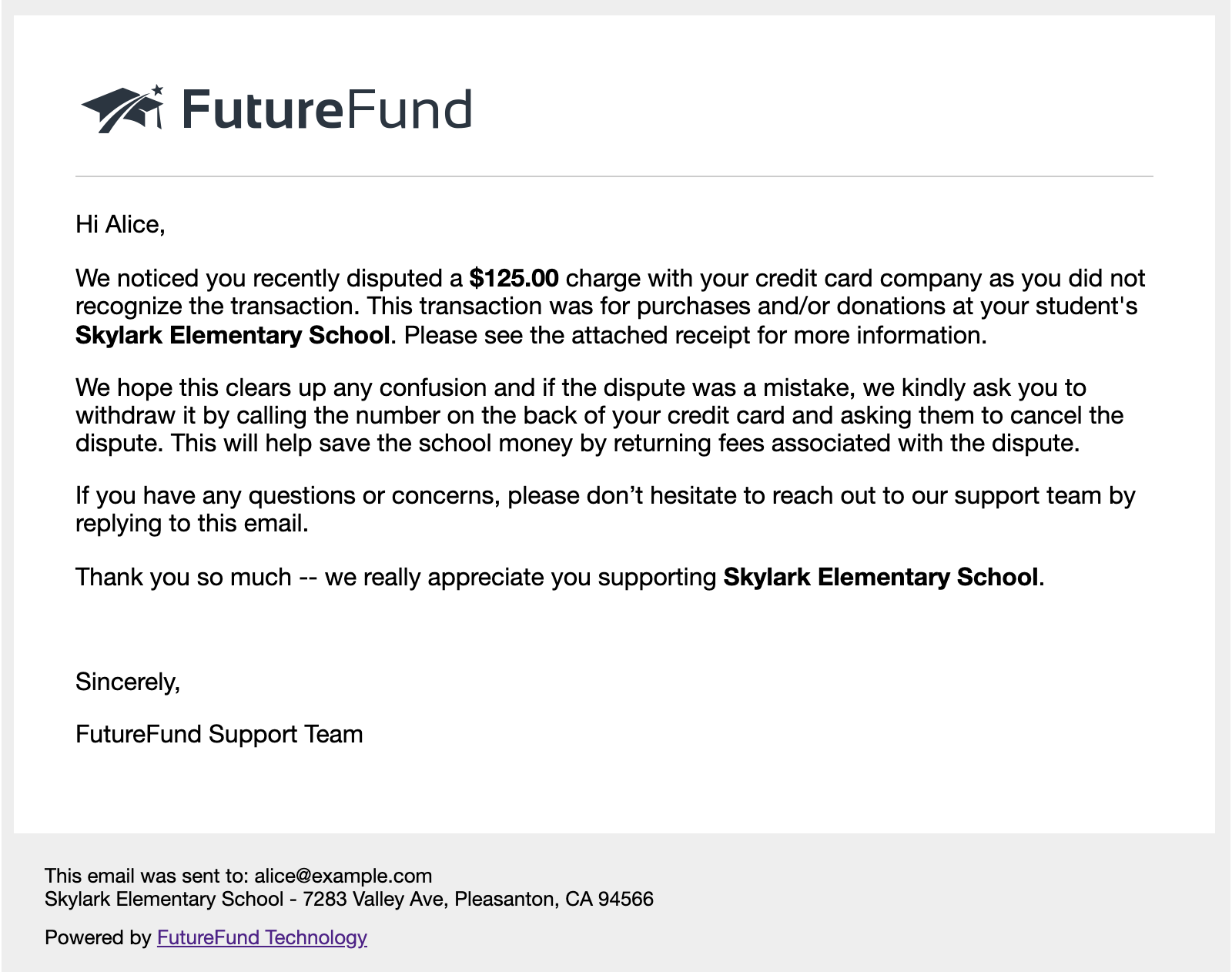

The following email is sent to the purchaser and account owner when a dispute is received by FutureFund. With respect to this email:

- The messaging cannot be customized and the email cannot be disabled

- The

Fromaddress is set to support@futurefund.com - The receipt is included as an attachment in the email

The following emails are sent to the account owner when the dispute is won or lost. No email is sent to the purchaser.

Fees

When a dispute is lost, a $15.00 fee will be deducted from your account balance.

Reporting

When a dispute is lost, the amount of the dispute along with the fee is deducted from the fund’s account balance. If more than one fund is involved in the dispute, the amount is prorated between the funds based on the amount of the purchase.

The amount deducted is displayed as a refund in the reports and exported CSV files.

Notes

- Disputes are decided by your customer’s bank and their decisions are final. When a decision is rendered, they are not required to provide a rationale for their decision.

- We encourage you to reach out to the purchaser to help remedy their dispute. If they realize they made a mistake, they can cancel the dispute by contacting their credit card company.

- When a dispute has been created, refunds are no longer possible for the disputed transaction.

- Disputes usually take 60-75 days to resolve.

- When an order is in dispute, it is the admin’s responsibility to determine if products should be fulfilled.

Was this helpful?